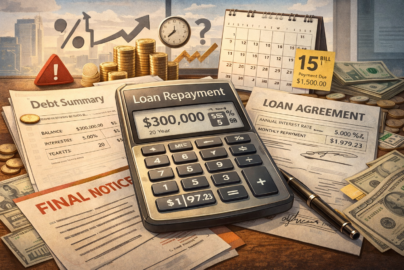

Loans are often framed as simple trade-offs.Borrow an amount, pay it back over time, move on. In reality, loan decisions…

SCENARIOS

Financial scenarios, not recommendations.

Side-by-side paths showing how assumptions, risk, and time change long-term outcomes.

-

-

Financial Independence and Retire Early — FIRE — often begins with a simple question:How much is enough? A FIRE calculator…

-

What would change if you stopped treating “financial freedom” as a vague destination—and started treating it as a date on…

-

Copper has long been treated as a cyclical signal—rising with construction booms and fading when growth slows. That framing is…

-

For years, the conversation around FIRE has been dominated by tactics: asset allocation, withdrawal rates, tax efficiency, optimisation. Useful, but…

-

What if the advantage most people are chasing in markets—better information, faster reactions, smarter forecasts—is the wrong one entirely? That…

-

The obvious question many investors are asking about 2026 is political: what will the next administration do?A more useful question…

-

The most common misunderstanding about FIRE is also the most limiting one.Many people hear Financial Independence, Retire Early and imagine…

-

The simple path isn’t about money. It’s about control. What if the real problem with money isn’t that it’s complicated—but…

-

The question most investors ask is deceptively simple:Is it better to invest a lump sum all at once, or spread…