Scenarios — Where assumptions are tested, not repeated

This section brings together scenario-based essays that examine how different financial choices play out over time.

Rather than focusing on what to invest in, these pieces explore what must be sustained — across returns, risk, inflation, debt, and time.

Each article compares realistic paths side by side:

different assumptions, different constraints, different long-term outcomes.

The goal is not to provide answers or recommendations, but to expose hidden trade-offs —

and to show how small differences in structure can compound into very different results.

This is where financial decisions are questioned before they are calculated.

- All

- SCENARIOS

The simple path isn’t about money. It’s about control. What if the real problem with money isn’t that it’s complicated—but...

The question most investors ask is deceptively simple:Is it better to invest a lump sum all at once, or spread...

Many people who pursue FIRE (Financial Independence, Retire Early) eventually ask the same question: “Once I stop working, how do...

What Benjamin Graham Really Teaches Us About Freedom What if the biggest risk in investing isn’t the market—but the way...

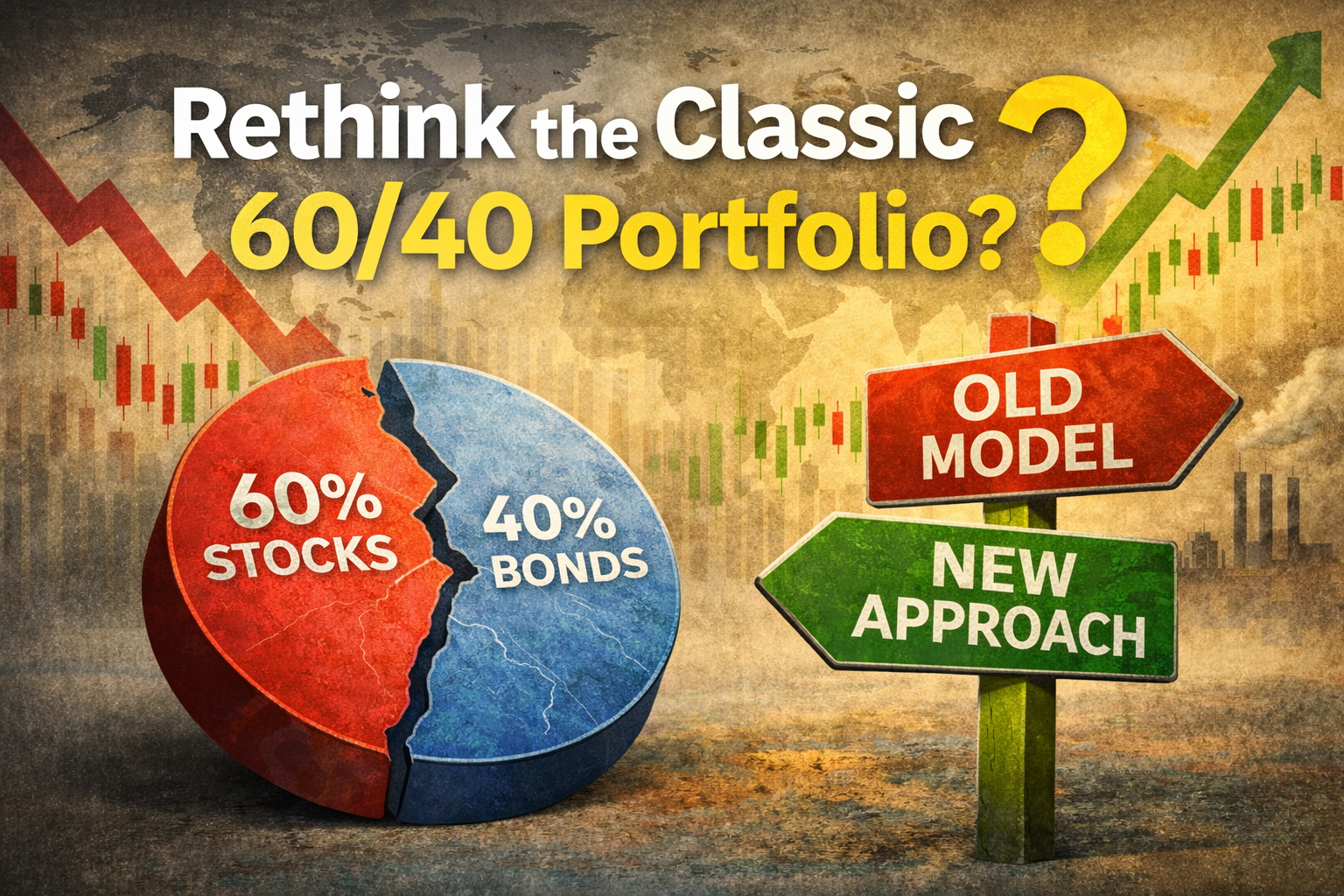

For decades, the 60/40 portfolio sat quietly at the center of global investing. Sixty percent equities for growth, forty percent...

“Money is never just money. It’s the mirror that reflects who you truly are.” Money decisions look rational on the...